Exness New Zealand

Overview

Exness New Zealand, a leading online broker, offers a wide range of trading services to clients from around the world. The Financial Markets Authority (FMA) regulates Exness New Zealand. Also, became a member of the Financial Services Complaints Limited (FSCL) in 2008. Exness Forex broker offers a range of trading instruments, including Forex, CFDs, commodities, indices, and cryptocurrencies. It also provides a range of educational resources and tools to help traders of all levels improve their trading skills. With competitive spreads, fast execution speeds, and a range of trading platforms, Exness New Zealand is a great choice for traders looking for a reliable and secure broker.

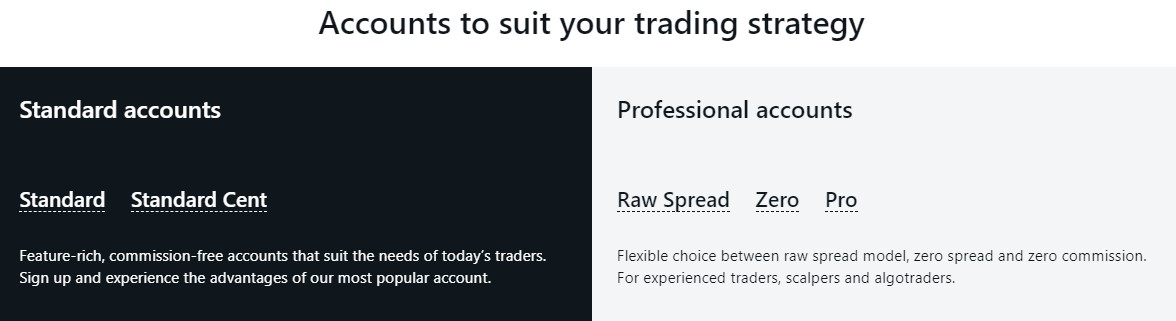

Exness in New Zealand – Account Types

Exness New Zealand offers a range of account types to cater to the diverse trading needs of its clients.

- Standard Account: The Standard Account is designed for traders who prefer a more traditional trading environment. It offers competitive spreads, fast execution, and no commission fees. This account type is suitable for both beginner and experienced traders.

- Standard Cent Account: The Standard Cent Account is specifically designed for those who want to start trading with smaller initial investments. With this account type, traders can access the same trading conditions as the Standard Account but with lower contract sizes. It allows traders to test their strategies and gain experience in a real trading environment.

- Raw Spread Account: The Raw Spread Account is ideal for traders who prioritize low spreads and reduced trading costs. This account type offers raw interbank spreads with no markup and low commissions. It is particularly suitable for traders who engage in high-volume trading and require tight spreads for maximum profitability.

- Zero Account: The Zero Account is specifically tailored for traders who prefer to trade with zero spreads. This account type charges a fixed commission per trade instead of spreads. It is suitable for scalpers and traders who rely heavily on precise entry and exit levels.

- Pro Account: The Pro Account is designed for professional traders who require advanced trading features and tools. It offers institutional-grade liquidity, ultra-fast execution, and competitive pricing. This account type caters to traders who rely on sophisticated trading strategies and techniques.

Overall, Exness New Zealand provides a comprehensive range of account types to cater to the specific needs of different traders. Whether you are a beginner or a seasoned professional, there is an account type that suits your trading style and preferences.

READ: easyMarkets New Zealand

Financial Instruments Available in Exness New Zealand

Exness New Zealand provides its clients with a wide range of financial instruments. They design these instruments to meet the needs of traders of all levels, from novice to experienced. The instruments they offer include Forex, CFDs, Spot Metals, Futures, and Cryptocurrencies.

Forex

Exness offers Forex, the most popular financial instrument. Forex is a global market for trading currencies and holds the title of the largest and most liquid financial market in the world. Exness New Zealand provides a wide range of currency pairs, including major, minor, and exotic pairs.

CFDs

Traders can speculate on the price movements of a wide range of underlying assets, such as stocks, indices, commodities, and cryptocurrencies, using CFDs, or Contracts for Difference. CFDs are derivative instruments that traders can use to open positions with a fraction of the total value of the underlying asset, as they are leveraged instruments.

Spot Metals

Exness New Zealand offers to trade in gold, silver, platinum, and palladium on the spot market. Traders trade Spot Metals in lots, with each lot representing a certain amount of the metal.

Futures

Futures are contracts that allow traders to speculate on the future price of an underlying asset. Exness New Zealand offers futures contracts on a range of commodities, such as oil, natural gas, and agricultural products.

Cryptocurrencies

Cryptocurrencies are digital assets that are traded on the blockchain. Exness New Zealand offers trading in a range of popular cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple.

These financial instruments are available to Exness New Zealand clients through the MetaTrader 4 and MetaTrader 5 trading platforms. Both platforms offer a range of features and tools to help traders make informed decisions and maximize their trading potential.

Trading Platforms

Exness New Zealand offers a variety of trading platforms to cater to the diverse needs of traders. One of their popular trading platforms is the Exness Trade App, which provides a user-friendly interface and advanced trading tools to facilitate seamless trading on the go.

Another trading platform offered by Exness New Zealand is the Exness Terminal, which is a comprehensive trading platform that combines advanced charting features, real-time market data, and customizable indicators to enhance the trading experience.

Exness New Zealand also provides access to the globally recognized MetaTrader 5 platform, which offers advanced trading functionalities and a wide range of analysis tools for traders to make informed decisions. Additionally, MetaTrader 4, another highly acclaimed trading platform, is also available, offering a user-friendly interface and a plethora of trading tools and indicators.

For traders who prefer to access their trading accounts through a web browser, Exness New Zealand offers the MetaTrader WebTerminal. This platform allows traders to access their accounts and execute trades directly from any web browser without the need for downloading or installing any software.

Furthermore, Exness New Zealand ensures that traders can stay connected and trade on the move with the MetaTrader Mobile platform. This mobile application enables traders to access their trading accounts from their smartphones or tablets, providing them with the flexibility to monitor the markets, execute trades, and manage their positions from anywhere at any time.

Fees and Charges

As with any trading platform, there are certain fees and charges associated with using Exness New Zealand.

The fees and charges associated with Exness in New Zealand depend on the type of account you open. For example,

- the Standard account has a commission of 0.03% per side

- the Zero account has no commission

- the Pro account has a commission of 0.02% per side

In addition to the commission, Exness also charges a spread. The spread is the difference between the bid and ask prices of a currency pair. The spread is typically expressed in pips, which is the smallest unit of price movement.

- The spread for the Standard account is 0.3 pips

- the spread for the Zero

- Pro accounts are 0.2 pips.

The broker also charges an overnight fee for positions that are held overnight. This fee is calculated as a percentage of the position size and is charged on a daily basis.

- the Standard account is 0.03%

- the Zero

- Pro accounts are 0.02%

Finally, Exness New Zealand also charges a withdrawal fee. This fee is charged when you withdraw funds from your account. The withdrawal fee is 0.5% of the amount withdrawn.

Deposit and Withdrawal Options

Exness New Zealand offers a wide range of convenient deposit and withdrawal options for its clients, ensuring seamless and secure transactions. With an emphasis on efficiency and convenience, Exness New Zealand provides various methods for both depositing funds into trading accounts and withdrawing profits or funds.

When it comes to depositing funds, Exness New Zealand clients can choose from several options. These include bank wire transfers, credit and debit cards (Visa and Mastercard), local bank transfers, and various electronic payment systems like Neteller, Skrill, and WebMoney. These options cater to the diverse needs of clients, allowing them to choose the most suitable method based on their preferences and availability.

The processing time for deposits on Exness New Zealand depends on the chosen method. For bank wire transfers, the processing time may vary depending on the client’s bank and country. However, electronic payment systems usually offer instant deposits, allowing clients to fund their trading accounts immediately and take advantage of market opportunities without delay.

Similarly, Exness New Zealand ensures that clients can withdraw their profits or funds easily and efficiently. Clients can use the same deposit methods for withdrawals, making it convenient and straightforward. The processing time for withdrawals may vary depending on the chosen method and additional verification processes. However, Exness New Zealand strives to process withdrawals as quickly as possible, aiming to provide a seamless experience for its clients.

In summary, Exness New Zealand offers a diverse range of deposit and withdrawal options, catering to the needs of its clients. With efficient processing times and various payment methods, clients can fund their accounts and withdraw their funds hassle-free. Exness New Zealand prioritizes convenience, security, and client satisfaction, ensuring a seamless trading experience for all.

Educational Resources

Exness New Zealand provides a range of educational resources to help traders of all levels improve their trading skills. These include:

- Video tutorials: provide step-by-step guidance on how to use our trading platform and how to trade different financial instruments.

- Webinars: offer traders with the opportunity to learn from experienced traders and ask questions in real-time.

- Trading guides: Exness trading guides provide comprehensive information on different trading strategies and how to use them.

- Market analysis: The market analysis provides traders with up-to-date information on the latest market trends and news.

Customer Support

Exness New Zealand also offers a range of customer support services to ensure that our customers have the best possible trading experience. These include:

- 24/7 customer service: customer service team is available 24/7 to answer any questions or queries you may have.

- Live chat: the live chat service allows you to get in touch with our customer service team quickly and easily.

- Email support: an email support team is available to answer any questions or queries you may have.

- Phone support: a phone support team is available to answer any questions or queries you may have.

The Benefits of Trading with Exness New Zealand

Exness New Zealand is an online trading platform that offers a range of services to traders in the country. The platform provides access to a wide range of financial instruments, including forex, commodities, indices, and stocks.

It also offers a range of trading tools and features, such as automated trading, copy trading, and a range of educational resources.

The platform is regulated by the Financial Markets Authority (FMA) in New Zealand, which ensures that the platform is compliant with the country’s financial regulations. This provides traders with the assurance that their funds are secure and that their trading activities are conducted in a safe and secure environment.

Exness New Zealand offers a range of benefits to traders. These include low spreads, fast execution speeds, and a range of trading tools and features.

The platform also offers a range of educational resources, such as webinars, tutorials, and market analysis. This allows traders to gain a better understanding of the markets and develop their trading strategies.

Is Exness in New Zealand Legal?

Yes, Exness is a legal broker in New Zealand. The Financial Service Providers Register (FSPR) registers the company and the Financial Markets Authority (FMA) regulates it. The broker also holds membership in the Financial Dispute Resolution Scheme (FDRS). This offers a dispute resolution service for customers with complaints against financial service providers. Exness ensures the protection of customers and resolves their complaints in a timely and fair manner. Exness forex broker is committed to providing its customers with a secure and transparent trading environment, and its compliance with New Zealand regulations demonstrates this commitment

Conclusion

Exness New Zealand is a great choice for traders looking for a reliable and secure broker. It offers a wide range of trading instruments, competitive spreads, and a user-friendly platform. The customer service team is also very helpful and responsive. With its low minimum deposit requirement and fast withdrawal process, Exness New Zealand is an ideal choice for both experienced and novice traders.

READ: FBS New Zealand