AvaTrade New Zealand

Overview

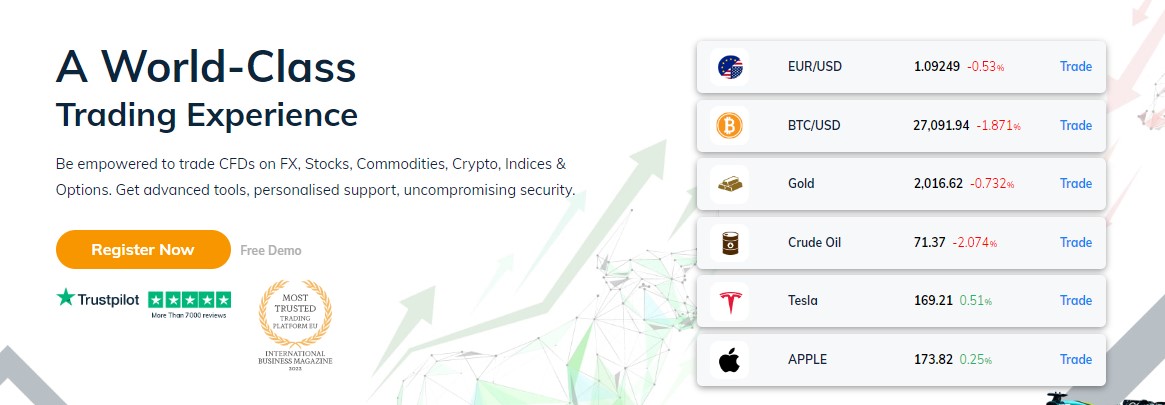

AvaTrade New Zealand leads the online trading platform industry by providing traders with access to a wide range of financial markets. It focuses on offering a secure and reliable trading environment. It also provides traders with a comprehensive suite of trading tools and services to assist them in making decisions.

The Financial Markets Authority (FMA) regulates AvaTrade New Zealand. The company is also a member of the Financial Services Complaints Limited (FSCL). AvaTrade New Zealand commits to providing its clients with a safe and secure trading environment and offers a range of features and services to help traders maximize their trading experience.

AvaTrade New Zealand – Account Types

AvaTrade New Zealand offers a range of different account types to suit the needs of different traders. Whether you are a beginner or an experienced trader, AvaTrade has an account type to suit your needs.

Standard Account – Suitable for beginner traders who are just starting out in the world of trading. It offers a range of features such as low spreads, leverage up to 1:400, and access to a wide range of markets.

Professional Account – Perfect for experienced traders who are looking for more advanced features. It offers a range of features such as higher leverage up to 1:400, access to a wide range of markets, and access to advanced trading tools.

Islamic Account – This account is suitable for traders who follow the Islamic faith and wish to trade in accordance with Sharia law. It offers a range of features such as no interest or swap charges, access to a wide range of markets, and access to advanced trading tools.

Demo Account – The account is great for traders who wish to practice their trading skills without risking any real money. It offers a range of features such as access to a wide range of markets, access to advanced trading tools, and the ability to practice trading without risking any real money.

Trading Assets Available in AvaTrade New Zealand

AvaTrade New Zealand offers a wide range of trading assets to its clients. These include Forex, CFDs, stocks, indices, commodities, cryptocurrencies, ETFs, and bonds.

- Forex: AvaTrade New Zealand offers more than 55 currency pairs, including major, minor, and exotic pairs.

- CFDs: The broker offers a wide range of CFDs, including indices, commodities, stocks, and cryptocurrencies. This allows traders to take advantage of price movements in different markets without having to own the underlying asset.

- Stocks: AvaTrade forex broker offers a wide range of stocks from major exchanges around the world.

- Indices: The platform offers a wide range of indices, including major indices from around the world.

- Commodities: AvaTrade Forex offers a wide range of commodities, including energy, metals, and agricultural products.

- Cryptocurrencies: The broker offers a wide range of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple.

- ETFs: AvaTrade New Zealand broker offers a wide range of ETFs, including equity, fixed income, and commodity ETFs.

- Bonds: AvaTrade Forex New Zealand offers a wide range of bonds, including government, corporate, and municipal bonds.

Trading Platforms

WebTrader is a user-friendly web-based platform that allows traders to access their accounts and trade various financial instruments directly from their web browser. With its intuitive interface and advanced charting tools, WebTrader provides a seamless trading experience.

AvaOptions is a cutting-edge platform specifically designed for options trading. It provides traders with a comprehensive range of options strategies, customizable risk management tools, and real-time market data. With AvaOptions, traders can optimize their options trading strategies and potentially increase their profitability.

AvaTradeGo is a mobile application that enables traders to access their accounts and trade on the go. It offers a wide range of features, including real-time quotes, customizable watchlists, advanced charting tools, and one-click trading.

MetaTrader 4 & 5 are highly popular trading platforms known for their robust functionality and extensive range of tools. These platforms provide traders with a wide selection of technical indicators, advanced charting capabilities, and automated trading options. With MetaTrader 4 & 5, traders can create and implement their own trading strategies or choose from a vast library of pre-built strategies.

AvaSocial is a social trading platform that enables traders to connect and interact with other traders. It allows users to view and copy the trades of successful traders, providing an opportunity to learn from experienced professionals and potentially improve trading performance.

DupliTrade is an automated trading platform that allows traders to automatically replicate the trades of selected strategy providers. With DupliTrade, traders can benefit from the expertise of successful traders, even if they lack the time or knowledge to trade themselves.

Capitalise.ai is an AI-powered trading platform that enables traders to automate their trading strategies without the need for coding. It provides a user-friendly interface where traders can create, backtest, and execute their trading strategies using natural language commands.

Special Features

AvaTrade New Zealand offers a range of special features to help traders make the most of their trading experience.

- Automated Trading: AvaTrade New Zealand allows traders to set up their own trading strategies and automatically execute them. This feature is perfect for individuals who wish to capitalize on market opportunities without the need to constantly monitor the markets.

- Expert Advisors: The broker also provides Expert Advisors, which help traders make better decisions through automated trading systems. These systems are designed to analyze the markets and offer signals to traders on when to enter and exit trades.

- Trading Platforms: AvaTrade Forex New Zealand offers a range of trading platforms. These include the popular MetaTrader 4 and 5, as well as the AvaTradeGO mobile app. These platforms make trading easier and more efficient, with features such as charting tools, technical indicators, and automated trading.

- Low Fees: AvaTrade New Zealand offers competitive fees and spreads, making it an attractive option for traders looking to save on trading costs.

Fees and Charges

AvaTrade New Zealand offers a range of fees and charges for its services. These fees and charges vary depending on the type of account and the services used.

For trading, AvaTrade New Zealand charges a commission fee of 0.04% of the total value of the trade. This fee is applicable to all trades, regardless of the size or type of the trade.

In addition to the commission fee, AvaTrade New Zealand also charges a spread fee. This fee is calculated as the difference between the bid and asks prices of the currency pair being traded. The spread fee is typically between 0.1 and 0.5 pips, depending on the currency pair being traded.

The broker also charges an inactivity fee of $50 per month for accounts that have not been active for more than three months. This fee is applicable to all accounts, regardless of the type or size.

Finally, AvaTrade New Zealand also charges a withdrawal fee of $25 for all withdrawals. This fee is applicable to all withdrawals, regardless of the amount or type of withdrawal.

Deposit and Withdrawal Options

AvaTrade New Zealand offers a range of deposit and withdrawal options for its clients. These include bank transfers, credit/debit cards, and e-wallets. The processing time for each of these options varies.

Bank Transfers: Bank transfers are the most common method of deposit and withdrawal for AvaTrade New Zealand clients. The processing time for bank transfers is usually between 1-3 business days.

Credit/Debit Cards: Credit/debit cards are a convenient and fast way to deposit and withdraw funds from AvaTrade New Zealand. The processing time for credit/debit cards is usually instant.

E-Wallets: E-wallets are a popular option for AvaTrade New Zealand clients. The processing time for e-wallets is usually instant.

Overall, AvaTrade New Zealand offers a range of deposit and withdrawal options with varying processing times. Bank transfers are the most common method of deposit and withdrawal and usually take 1-3 business days to process. Credit/debit cards and e-wallets are also available and usually process instantly.

Advantages

The benefits of trading with AvaTrade New Zealand include:

- access to a wide range of markets

- competitive spreads

- a range of trading tools and features

- a range of educational resources, such as webinars, tutorials, and eBooks.

Disadvantages

However, trading with AvaTrade New Zealand carries risks, as with any form of trading. These risks include:

- risk of market volatility

- the risk of leverage

- and the risk of trading losses

Education

AvaTrade New Zealand provides a range of educational resources to help customers learn more about trading and the markets. These resources include webinars, tutorials, eBooks, and videos. The webinars cover topics such as trading strategies, risk management, and technical analysis. The tutorials provide step-by-step instructions on how to use the AvaTrade platform. The eBooks provide in-depth information on trading topics such as risk management and market analysis. The videos provide an overview of the markets and how to trade them.

Customer Support

AvaTrade New Zealand also offers a range of customer support services. Customers can contact the customer support team via phone, email, or live chat. The customer support team is available 24 hours a day, 5 days a week. Customers can also access the AvaTrade Knowledge Base, which provides answers to frequently asked questions.

Is AvaTrade in New Zealand Legal?

The Financial Markets Authority (FMA) regulates AvaTrade, an online broker that offers trading services in New Zealand. The broker is compliant with the Financial Service Providers Register (FSPR). AvaTrade is also a member of the Financial Dispute Resolution Scheme (FDRS). It ensures the protection of all clients and holds their funds in segregated accounts, making it a legal and secure broker for trading in New Zealand.

Conclusion

AvaTrade New Zealand is a great choice for those looking to trade in the Forex market. It offers a wide range of features and services, including competitive spreads, low commissions, and a variety of trading platforms. The company also provides excellent customer service and educational resources to help traders get started. With its reliable and secure trading environment, AvaTrade New Zealand is a great choice for those looking to trade in the Forex market.

READ: Exness New Zealand | FBS New Zealand